-40%

Cebora 1395 Nozzles x 10 - 50A - LT-70, LTM-70, CP-70 *1 Day Ship - US SELLER*

$ 10.55

- Description

- Size Guide

Description

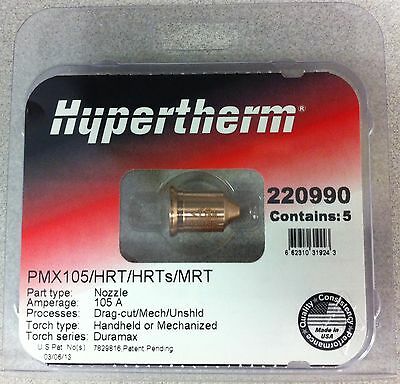

10Piece Cebora Plasma Cutter Extended Nozzles

Replacement Plasma Cutter Consumables Set

Part No: CB1395 - 10 x Extended Nozzles - 50A

for LT-70, LTM-70, CP-70 Torch

Highest Quality Replacements Available

Manufactured Exclusively by PlasmaDyn

©

Don't Wait 6 Weeks for your Parts !!

Ships NEXT DAY from America - US Seller

Auction Includes what is in the picture:

10 x CB1395 - Extended Length Nozzles Rated 50A

for LT-70, LTM-70, CP-70 Torches

All duties fees, customs inspections, bonds, insurance, and all other fees already paid for.

Shipping:

We ship

WORLDWIDE - everyday including Saturday

after we receive notification that payment has cleared.

Free Shipping to Lower 48 States ONLY

Shipping to Alaska, Hawaii, Us Protectorates Please add .00

All other buyers responsible for all shipping and import costs.

Check Ebay shipping calculator - or ontact us before placing order.

Payment:

We accept PayPal and credit cards via the Phone, but only ship to the address on file.

Payments must be made within 3 days of auction close.

For questions please call: 314-329-8553

Returns:

There are NO RETURNS OR EXCHANGES on electrical parts or engine parts.

If the package is damaged, YOU MUST FILE A SHIPPING CLAIM

Notes: opened packages are not returnable.

Support:

WE STRIVE TO PROVIDE THE BEST PRODUCT AND THE BEST SUPPORT

IF YOU NEED HELP, PLEASE ASK - WE ARE HERE TO HELP

If you feel that we did not deliver 5 Star Feedback let us know FIRST - So we can MAKE IT RIGHT

NOTE: Purchasing a product direct from China and having item labeled as sample or gift to avoid paying fees due the United States, is illegal. For the buyer. And customs is watching.

Americans buy made-in-China items all the time, but circumventing customs fees only hurts America.

Please help support the United States by purchasing from an

American Company

that

PAYS TAXES

We pay ALL fees & taxes required when importing a product.Look for U.S. Seller or ships from United States.

UNITED STATES FEDERAL CIVIL PENALTIES - AVOIDING CUSTOMS DUTIES

Per US Code 19 U.S.C. Section 1592

1. Civil Penalties

Under the U.S. customs laws it is unlawful to enter, introduce, attempt to enter or introduce any merchandise into the United States

by means of a material false statement or omission, whether by fraud, gross negligence or negligence

. It is also unlawful to aid another in doing so.

An importer

(

YOU the Ebay buyer who is AVOIDING PAYING DUTIES

) is strictly liable for the accuracy of all information stated on documents filed with Customs or back-up what Customs requires the importer to maintain.

Such information includes identification of country of origin, price paid to the seller, value of assists, commissions, tariff classification and eligibility for free entry under the various Free Trade Agreements or other duty exemptions.

The importer must also be able to document the accuracy of such information

. Failing to do so means exposure to penalties. In classification (duty rate) and valuation errors, these range from the assessment of the duties owing plus and additional 200% for simple negligence, 400% for gross negligence, and

800% for civil fraud. Where Customs believes the fraud extreme, it can also seek criminal penalties

.

The amounts of penalties imposed depend upon the level of culpability, but can be up to the domestic value of the imported merchandise.

If Customs believes that an importer fraudulently evaded duties, it may assess a penalty up to the amount of the U.S. resale value of the merchandise

. “Fraudulently” means done voluntarily and intentionally, with an intent to deceive, to mislead, or convey a false impression. If Customs believes that an importer violated Customs laws because of gross negligence, it may impose a penalty of up to four times the loss of Customs duties, or if no duties were involved, up to 40% of the dutiable value of the imported merchandise. “Gross negligence” means that the importer was seriously negligent, acting with actual knowledge or wanton disregard for its legal obligations. If Customs believes that an importer was negligent, it may impose a penalty of up to two times the loss of Customs duties, or if no duties were involved, up to 20% of the dutiable value of the imported merchandise. “Negligence” means a mistake or error that Customs believes an importer exercising reasonable care would not have made.

2.

Criminal Penalties

Criminal penalties may result from fraud, gross negligence or negligence as well as the failure to maintain the records on the (a)(1)(A) list.

Willful fraud carries a maximum penalty of 20 years in prison and a 0,000 fine or 75% of the appraised value may be imposed for each release of merchandise

. If Customs deems the failure to be a result of negligent behavior, the fine imposed may reach up to ,000 or 40% of the appraised value.